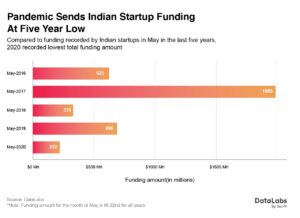

COVID-19 is having an adverse effect on private equity and venture capital investments in India. As per industry reports and experts’ views, PE and VC investments in India may decline up to 60% in 2020 due to the pandemic.

In 2019, PE and VC investment activities reached a record high at US$48 billion in India. However, EY has projected PE and VC investment at US$19-26 billion in 2020, which shows a decline of 45-60% compared to 2019.

Sectors in prominence

Nevertheless, every crisis throws up some opportunities, and the sectors listed below have shot in prominence with PE and VC investors looking to invest in companies in these sectors.

Nevertheless, every crisis throws up some opportunities, and the sectors listed below have shot in prominence with PE and VC investors looking to invest in companies in these sectors.

- Technology, including education technology, online gaming and select e-commerce;

- Consumer goods, including packaged essentials and personal products;

- Ready foods processing;

- Pharmaceutical, including diagnostic, medical supply, biotech and services;

- Agricultural products and services; and

- Specialty chemicals.

Indian education start-ups have already raised 96% of the amount they raised in 2019. Reliance Jio, the mega telecom and technology conglomerate owned by billionaire, Mukesh Ambani, has raised over US$20 billion from marquee PE and strategic investors in the middle of the lockdown, showing that money never sleeps.

Emerging trends

Focus on different deal terms

According to a press release dated July 14, 2020 of the National Venture Capital Association (NVCA) of the US, both, VC fundraising and investment activity have slowed down considerably in the US due to the pandemic. Moreover, exit activity of VCs has also been the lowest since 2011.

The result is that investors have started demanding deal terms designed to limit their risk. Rachel Proffitt, a partner at the US law firm, Cooley, commented in a PitchBook article that, “some venture capitalists have sought to further protect their investments by securing veto powers for the board members, strengthening operational controls, and in rare cases instituting pay-to-play incentives to prod other investors to participate in current or future funding rounds.”

Similarly, in India too, VC and PE investors are seeking provisions to protect their investments. Investors are giving more attention to:

• anti-dilution,

• liquidation preference, and

• dividend rights clauses

In addition, they are also imposing tighter restrictions on the use of funds. Overall, the emphasis is on profitability than on unbridled growth with a high cash burn.

Due diligence

The due diligence process for investments has undergone a sea change. Already there is lesser reliance on physical meetings and site visits. Additionally, the extended focus of due diligence is on force majeure and termination clauses in commercial contracts, liabilities towards the medical care of employees, and compliance with data protection laws.

Press Note 3 and the Chinese App ban

The recent change in India’s foreign investment policy through Press Note 3 (requiring prior government approval for direct or indirect Chinese investment in Indian companies) and the ban of various Chinese apps like TikTok has also slowed down the start-up ecosystem in India, because Chinese funds and companies have emerged as big investors in Indian technology companies in the last couple of years and are now unable to do quick follow-on rounds.

Exits

Exit activity in India, including IPOs, and open market and strategic M&A, was robust before COVID-19 hit. However, since then, the exit momentum has been negatively impacted, and investors may have to hold on to their investments for longer periods so as to enable their portfolio companies to come out of this phase successfully.

Increased Risk of Litigation

There is a rise in conflicts between the founders and investors, because of different economic motives. Not all investors have the luxury of time and are pushing for mergers with similar businesses to salvage their investments, even if the merger terms are not in their favour.

This has resulted in company boards facing litigation from founders and minority shareholders. As a general rule, a board must act in good faith and with prudent judgment. However, in turbulent economic circumstances, the decisions of the directors get closely examined by courts. This will result in the intentions of directors being questioned, and directors may have the burden of proving the fairness of transactions.

Directors must, therefore, take steps to reduce the risk of litigation, as for example, carefully disclosing the terms of any financing, documenting each step taken with reasons, and including the founders and minority shareholders in all discussions.

The Future is Bright!

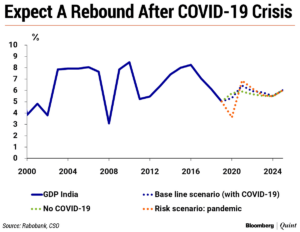

There is always a light at the end of a grim tunnel. According to Silicon Valley’s noted venture capitalist and co-founder of Sand Hill Group, M R Rangaswami, the next 10 years will be India’s “golden moment” in key sectors like technology, pharmaceutical, e-commerce and manufacturing. He highlighted the US$20 billion foreign investment in Reliance Jio during COVID-19 lockdown as testament to this. He also commented that PE and sovereign funds from around the world will be looking at India as a hot destination for technology money, as the entire business ecosystem in India is adapting to new technologies like never before. The pandemic has forced everybody to go digital, and India already has an advantage with a high market penetration of cell phones (over 500 million users likely to grow to a billion).

Therefore, the future is bright and full of opportunities for India.